E-commerce payment processing essentials

E-commerce business has expanded at such an exponential level in the last few years, it is estimated that by 2025 more than 23% of all sales will be conducted online. Hence, improving and securing the online shopping experience has become extremely important. The payment processing method is a central part of the e-commerce network, as it is one aspect that can make or break your business. It not only helps build trust and loyalty for your brand but also assists in optimizing your conversions.

A recent study has shown that SMEs that offer multiple payment options can increase their revenue by nearly 30%. So setting up various options for your customers and ensuring security, reliability, and user-friendliness, can make your online store thrive.

Introduction to e-commerce payment processing

Setting up e-commerce payment solutions may seem like a daunting task, especially if you are new to the online business and have less technical knowledge. It is crucial to your enterprise as not only does it keep the organization running, but also manages sensitive client information.

Most people believe that transactions just happen automatically with a few clicks of a button. But this process entails many factors, such as the customer, merchant, payment processor, account services, and both the client’s and seller’s respective banks. The rewards of selecting the right e-commerce payment processing services for your store can not only help capture more than 19% of users who are likely to abandon their checkout because of mistrust but also generate more revenue for your business.

In this guide, we will explain the inner workings of an e-commerce payment system and also help you find the right one for your online store.

Understanding e-commerce payment systems

The e-commerce payment system is everything that happens once an online enterprise accepts a money transfer from a client. It includes authorizing the transaction, securely transmitting card data, and ensuring the merchant receives the funds. This whole process includes a payment gateway and a payment processor.

What is e-commerce payment processing?

Online payment processing is the system that allows e-commerce stores to accept and process electronic payments for goods and services rendered. It involves the secure exchange and transmission of transaction details between consumers, merchants, and payment service providers. It also entails a payment processor to authorize, capture, and settle funds.

E-commerce payment processing vs. traditional payment processing

As you are aware, traditional payment systems work on a concept where merchants use third-party getaways to finish their checkout process. In the earlier format, a customer is redirected to a secure online web page on the third party’s website, where they enter their transaction information to complete the purchase.

The newer e-commerce merchant processing works similarly but is already integrated into the store’s website. The transfer details are entered into the checkout web page and the processing happens without any redirection. Think of it as a one-stop shop that helps build a higher grade of trust between customer and merchant. When consumers are redirected to a third-party site to complete a transaction, they become a little skeptical and doubt the security of your brand. The e-commerce payment processing systems help online shoppers convert more easily and establish trust in the long run.

Main e-commerce payment methods

Many methods can be used to complete a transaction online. If you do not provide the desired method to your target audience, you risk losing a conversion as many people abandon their carts if their preferred option is unavailable. So make sure you prioritize the most popular e-commerce payment methods and implement them in your website. A few of the main ones you need to add to your portal are:

Credit and debit cards

No matter how many newer technologies come up, credit and debit cards are still very popular methods today. They account for around 20% of all e-commerce transactions worldwide. When a customer buys from an online store, a processor contacts the issuer, such as Visa, Mastercard, etc., for authorization. Pending approval, the funds are then transferred to the merchant’s bank account. Due to the growing popularity of digital wallets, it is expected that there might be a steady decline in credit and debit card usage.

Benefits of credit and debit cards:

- universal acceptance

- accessibility

- security

Challenges of credit and debit cards:

- fraud vulnerabilities

- fee structures

Mobile payments

The latest method to take the Internet by storm is mobile payments. They account for approximately half of all e-commerce transactions. It allows consumers to pay using their mobile phones by using methods like near-field communication (NFC) and QR codes. Some examples of this method are Apple Pay, Amazon Pay, Google Pay, and SMS payments.

Benefits of mobile payments:

- Convenient

- Secure

- Rising popularity and acceptance

Drawbacks of mobile payments:

- Limited coverage

- Needs a smartphone

- Sometimes expensive

Buy now, pay later (BNPL)

Buy now, pay later, or BNPL is a growing trend in the e-commerce field especially used by the younger generation. It is expected to reach $725.36 billion by 2030, as this popular system allows clients to split the cost of their goods into smaller more manageable payments, which are automatically debited from the account when due. An example of this method is Shopify’s Shop Pay installments, which breaks down the price of the product into smaller amounts and lets you receive the total order upfront.

Benefits of BNPL:

- financial flexibility

- streamlined process

- enhanced conversion rates

Challenges of BNPL:

- overspending/debt traps

- lack of a proper regulatory framework

Bank transfer

As the name suggests, bank transfers are a system that allows customers to transfer funds directly from their account to a merchant's bank account. They are a very reliable method of transaction and relatively less expensive than credit cards. With this technique, a user signs into their online banking application and manually traders money to the e-commerce business. Bank transfers are the fourth most popular method for e-commerce transactions globally.

Advantages of bank transfers:

- cost-effective

- transparency

- cross-border efficiency

Challenges with bank transfers:

- processing time

- lack of immediate gratification

How online payment systems work

The whole idea behind any payment gateway is to make processing effective, secure, and efficient. The system does not merely transmit money from one place to another, it approves the funds to the seller and does so safely and securely for the buyer. They follow compliance protocols and different security techniques to prevent fraud.

It is oftentimes difficult to understand a payment process, especially the difference between a payment processor and a payment gateway. Every transaction involves four primary parties to complete a transfer chain:

- customer

- merchant

- acquiring bank

- issuing bank

Every transaction aims to transmit money from the issuing bank to the acquiring bank based on the sales agreement between the customer and the merchant. This is enabled by the payment processor and payment gateway which helps connect all parts of the chain.

The payment process flow

The payment workflow follows three primary steps which can be better understood below with the following example:

Customer initiates payment

The online payment starts when customer enters their card information at the checkout stage, with the help of a form embedded into your website or mobile application. This encrypted data is sent to the processor with the help of payment gateways.

The payment processor, being a financial service provider, is responsible for transmitting data between the customer, the merchant, the issuing bank, and the acquiring bank. The processor provides your business with a credit card machine and any other equipment needed for accepting money in person.

On the other hand, the payment gateway is a technological platform whose job is to securely authorize transactions for e-commerce websites. Businesses cannot transmit payment information directly from their website to a payment processor to protect the customer’s privacy. The payment gateway acts as the guard between the customer’s information and the banks.

Processor authorizes the payment

Then the payment processor notifies the user’s bank to ensure there are sufficient funds in the account for the transaction. At this stage, either the transfer might be approved or declined and the data is sent back to the e-commerce website with the help of the payment gateway. If the transaction is authorized, the customer receives an order confirmation, usually in the form of a receipt.

Funds transfer to merchant account

Lastly, the merchant bank account allows the e-commerce store to receive electronic payments from the consumer. This happens after the transfer has been authorized and settled, meaning the actual funds get deposited into the business banking account, usually after one to two business days.

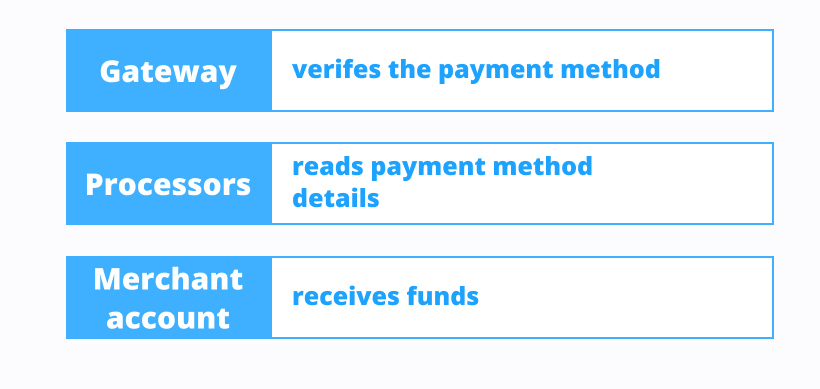

Key components of payment processing

Having a working knowledge of how payment processing works can help you with better decision-making for your e-commerce business. We have broken down the key components that provide the basic framework for understanding what goes on when a customer makes an e-commerce purchase.

Payment gateways

Payment gateways can be thought of as couriers who safely and securely carry your customer’s transaction information from your e-commerce website to the online payment processor. Depending on the setup, they can look different to consumers. For instance, if you hosted the payment portal on your platform directly, then your users can interact with the gateway right from a special input field on your website.

Other processors, like PayPal or Stripe, forward you to a new web page where the card information is input.

The gateway also performs the crucial task of authorizing transfers to ensure you receive the money on your end.

Payment processors

The next component is called payment processors. They are the entity that receives the secure customer data from the gateway and does the necessary technical work to approve it. The processor verifies that a payer has the necessary funds to complete the order, and then executes the transaction by taking the money from the consumer at the issuing bank and depositing it to the merchant bank account.

This may sound like the payment gateway only, but the gateway is just a messenger taking information, checking its authenticity, and delivering it. The processor is the technical officer who makes sure the money is dispatched and goes to the right place.

Merchant accounts

As the name suggests, merchant accounts are your business bank accounts that have been set up to receive money. There is also the possibility to send funds directly to any bank account, but for the e-commerce payment processing discussion we are looking at the merchant account as a place that receives funds.

Choosing the right e-commerce payment processor

Your designated payment processor is very vital to help secure your transactions. Hence there are several factors to consider for choosing a reliable provider. Here are some general things to consider when finding the right e-commerce payment processor for your business:

Security features and PCI compliance

Any online business that accepts, processes, stores, or transmits payment information, will need an SSL certificate, or secure sockets layer certificate. It is a code that applies to your web server and provides a layer of security for online communication and transactions. When a customer’s web browser contacts your website, the SSL certificate encrypts the connection, effectively shielding the user’s data from other people.

The next thing you have to ascertain is whether your e-commerce payment provider is PCI-compliant or not. PCI DSS, which stands for payment card industry data security standard, is a set of regulations merchants must follow to accept money online. This compliance is mandated by banking institutions to ensure the security of transactions passing through your processor.

Accepted payment methods and currencies

This factor is probably one of the most important features of your payment processor, especially for your customers. A great e-commerce payment system should cater to a variety of payment options, such as credit and debit cards, PayPal, Stripe, BNPL, Venmo, etc.

For example, while Visa and Mastercard are accepted the world over, it is a different story for American Express. Additionally, if your online store sells expensive goods, then customers may prefer an option that helps to break up their payments like buy now, pay later portals. By providing the maximum options to your users, you ensure a higher conversion and greater revenue generation for your e-commerce business.

International payment support

This is pretty much straightforward, if your business is only based in the USA, then you may not have to consider having international support. But it is helpful to have a payment processor that allows for international transactions and facilitates foreign transfers, in case you decide to expand your business abroad.

Your e-commerce payment gateway will also need to be able to support cards from various foreign banks and allow users to convert money to their desired currency. It should also offer support for navigating various tax systems.

Costs, fees, and pricing models

Costs associated with any e-commerce payment processor can be divided into three main components:

- set-up costs

- monthly subscription fee

- transaction fees

As a new business, this is a factor you should consider as getting trapped in paying astronomical fees for your processor can be detrimental to the growth of your online store.

Normally, companies charge a percentage or a fixed fee per transaction. But sometimes they can have a monthly fee structure or a subscription model instead. There are also extra costs you might be required to pay, like chargebacks, disputes, and international payments.

Having a firm knowledge of the number of transactions you expect, can help estimate your costs and find the right type of payment processor for your e-commerce business.

Integration and tokenization services

This service is used if you want the business to process recurring payments or store customer’s card information on file. Just directly saving transaction data is not advisable as it could be easily accessible to hackers and lead to a data breach.

E-commerce payment processors offer tokenization services to assist in storing users’ data. How it works is that the moment a piece of card information is captured, the processor converts the account numbers into a token of randomly generated alphanumeric code, which represents and replaces consumer information in your system. Later on, your platform uses this token instead of the card numbers when charging customers. This helps to protect your business and your users from hackers who might attempt to steal sensitive information.

4 Best payment options

For your comfort and ease, we have compiled a list of the top E-commerce payment options, which would be good for your online business. Analyze their data and fee structures to decide on the best payment platform that fulfills your company’s needs.

PayPal

PayPal is one of the most popular payment gateways in the market today. It has built a reliable reputation over the years and inspires much-needed confidence in buyers which helps drive conversions. It does not require setup fees and provides a merchant account as well with its Pro plan. PayPal functions as a complete business account and payment system to help your company with recurring bills and on-site checkout, and it accepts all major debit and credit cards. They offer a standard account that allows customers to purchase the system, but transactions are completed on PayPal’s web page. Some of the features of PayPal are:

- The transaction fee charged by PayPal of 2.7% + $0.30 of the sale amount.

- Fraud protection security on all their accounts without an additional charge.

- PayPal Express Checkout option.

Stripe

Stripe is another top payment option on the market, as it is very versatile in its functioning. It gained a lot of popularity because it offers on-site checkout without any monthly fees, unlike its competitors like Authorize.net. Though Stripe has mostly been used by big businesses like Booking.com, ASOS, and Deliveroo, it is designed for companies of all sizes. It handles recurring payments, accepts all major debit and credit cards from all countries, provides an option of a hosted payments page or an easy website integration with the click of a button, and provides its users with a merchant account. The transaction fee is 2.9% + $0.30 for every sale and an additional 1% charge for international cards. Stripe is a little difficult to set up for people with no experience in coding.

If you're just starting your e-commerce project, consider building your online store with SpreadSimple. It's a web application that allows you to easily build website without code in under 30 minutes and manage content in a simple Google Sheets document.

If you build your e-commerce store with SpreadSimple, you will be able to connect both Stripe and PayPal checkout with just a couple of clicks.

Square

Square is a payment option that is a great choice for those businesses that have a physical location and plan to start selling through an online store. They are known to have a superb POS system that seamlessly integrates their payment software with your E-commerce store. If you do not have an online store yet, then Square offers an E-commerce website builder as well with multiple drag-and-drop themes to create a good-looking website without any coding knowledge. Square is priced competitively and does not charge a monthly fee for adding the payment system to your website. The transaction fee is similar to Stripe and PayPal charged at 2.9% + $0.30 per transaction. Lastly, Square offers easy integrations with your website and other E-commerce partners like Wix, WooCommerce, SpreadSimple, and WordPress.

Google Wallet

Google Wallet is the most trustworthy payment platform in the market and for good reason too. The name Google is synonymous with trust. Their track record for enabling online activity and innovation was the reason behind the creation of Google Wallet. Most customers are likely to have a Google account, and if they have added their card to their system, then the transaction is very smooth. It offers a 2-click mobile system that is a particular boon in the online store model. The level of trust that comes with the name Google leads to higher conversion rates. The only downside of Google Wallet is the requirement of a Google account with a connected card is mandatory to use this platform, which can be an issue for new customers.

Enhancing customer experience with efficient payment processing

No matter what business you are starting, payments are a core component and directly affect your success. Selecting an e-commerce payment system is one of the most important business decisions you would be making as an owner. There are no shortages of payment processing services, but prioritizing customer experience with an efficient platform will ensure higher loyalty and conversions in the long run. Make sure you take into consideration the security features, acceptance of international transfers, fee structure, speedy checkouts, and ease of operation for your users. Remember, choosing a payment processor is only the first step in your journey, by giving weightage to client experience when setting up can enable online transactions that are easy for both you and your target audience.

Frequently asked questions about e-commerce payment processing

What are the best payment processors for e-commerce?

- PayPal

- Stripe

- Square

- Google Wallet

- Klarna

- Amazon Pay

Essential features in e-commerce payment processing?

Making sure you have a secure and reliable payment processing system is essential for any e-commerce business. These features include using trustworthy payment gateways, merchant accounts, and payment processing services that are PCI compliant. They help to ensure transaction information and other sensitive data are safe and secure.

How to accept payments in e-commerce?

You can follow the below-mentioned steps for accepting payment in e-commerce:

- Choose a payment processor.

- Integrate the processor with your platform.

- Offer a variety of payment methods in your store.

- Set a payout currency and schedule.

- Run a test payment.

- Launch and monitor the payment processing system.

What is API payment processing?

API payment processing is an application used to process payments from customers. By integrating APIs with websites or mobile platforms, users can for goods or services in just a few clicks using various payment types, including credit and debit cards, e-wallets, and bank transfers.

Conclusion

Choosing the best e-commerce payment solution depends on several factors and can sometimes be challenging. You must analyze your company’s requirements and match the parameters against certain platforms, the most important being trustworthiness. We hope our article helped you make an informed choice and eased your decision-making process.