Payment gateway integration: how to ensure seamless and secure payment on your website

Integrating a payment gateway into a website is essential for any online business that wants to make any sales at all. A seamless payment gateway integration ensures secure, efficient, and user-friendly transactions, allowing businesses to cater to a global audience.

Whether you're using Stripe for its versatile API capabilities or exploring other popular options, understanding how to integrate a payment gateway in your website is crucial for providing a smooth checkout experience.

This guide will walk you through the different types of payment gateways, their functions, and the steps to add payment gateways to your website. By the end of this article, you'll have a clear understanding of how to integrate an online payment solution tailored to your business needs, including practical examples like Stripe embedded checkout.

What is a payment gateway?

A payment gateway is a technology that captures and transfers payment data from the customer to the acquiring bank. It acts as an intermediary between a merchant's website and the financial institutions involved in the transaction. Payment gateways ensure that customer payment information is transmitted securely and that payments are processed efficiently.

Types of payment gateways

Understanding the different types of payment gateways can help you choose the best solution for your business needs. Here’s a detailed look at each type:

1. Hosted payment gateways. These gateways redirect customers to the payment service provider's (PSP) page to complete their transactions. When a customer decides to make a purchase, they are taken away from the merchant’s website to a secure page hosted by the PSP.

This method simplifies compliance with security standards like PCI DSS (Payment Card Industry Data Security Standard), as the payment service provider handles all sensitive payment data. Examples of hosted payment gateways include PayPal and Stripe Checkout. This type is often preferred by small to medium-sized businesses because it reduces the technical burden and security risks associated with handling payment data directly.

2. Self-hosted payment gateways. In this model, payment details are collected directly on the merchant’s website, giving businesses more control over the customer experience. Once the customer enters their payment information, the details are sent to the payment gateway’s URL for processing.

This method allows for a more seamless and branded checkout process, but it requires the merchant to ensure their site complies with security standards. Examples include Authorize.Net and Adyen. This type of gateway is suitable for businesses that want to maintain more control over the checkout process while still outsourcing the actual payment processing.

3. API payment gateways: These gateways provide merchants with complete control over the payment process through the use of APIs. By integrating an API, merchants can handle the payment processing directly on their website or mobile app, offering a fully customized payment experience.

This type of gateway is highly flexible and can be tailored to fit specific business needs, making it ideal for companies with strong development capabilities. Examples include Stripe and Braintree. API payment gateways are typically used by larger businesses or those with in-house development teams capable of managing the integration and security requirements.

4. Local bank integration. This type of gateway involves direct integration with a local bank's payment processing system. It is often used by larger businesses or enterprises that have established relationships with banks and prefer to route transactions through their own financial institutions.

This method can offer lower transaction fees and more control over the payment process. However, it also requires significant technical expertise and resources to implement and maintain. Local bank integrations are particularly common in regions where specific banking relationships are crucial for business operations.

How Do payment gateways work?

Payment gateways facilitate online transactions by encrypting sensitive information, such as credit card details, to ensure that data passes securely between the customer, the merchant, and the acquiring bank. The process typically involves:

- Customer places an order on the website and enters payment details.

- Website encrypts the payment information and sends it to the payment gateway.

- Payment gateway processes the transaction, verifying the customer's details with the issuing bank.

- Transaction is approved or declined based on the customer’s funds and validity of the information.

- Seller and customer are notified of the transaction status.

For a smooth online payment gateway integration, solutions like Stripe and PayPal offer comprehensive tools and documentation. Effective website payment integration ensures that businesses can add payment methods to their websites, providing seamless experience for customers.

Why Integrate a Payment Gateway?

Integrating a payment gateway into your website provides numerous advantages that can enhance your business operations and customer experience. Here are some key benefits:

Security. Payment gateways ensure that all transactions are secure by using advanced encryption technologies and adhering to industry standards like PCI DSS. This means that sensitive information, such as credit card numbers and personal details, is protected from fraud and unauthorized access. By using a payment gateway, you can assure your customers that their payment data is handled safely, building trust and credibility.

Convenience. A payment gateway allows customers to pay for products or services online quickly and easily. This seamless experience can significantly improve customer satisfaction. When customers find it easy to make payments, they are more likely to complete their purchases and return for future transactions. Features like one-click payments and saved payment details further enhance the convenience factor, making the checkout process smooth and efficient.

Efficiency. Automating payment processing with a gateway reduces the need for manual intervention, which minimizes the risk of human errors and saves time. Payment gateways streamline the entire payment process, from authorization and authentication to settlement and reporting. This automation frees up resources, allowing your team to focus on other critical aspects of your business, such as customer service and marketing.

Global Reach. Payment gateways enable businesses to accept payments from customers worldwide, expanding your potential market. They support multiple currencies and various payment methods, such as credit cards, debit cards, digital wallets, and bank transfers. This flexibility allows you to cater to a diverse customer base, making it easier for international customers to do business with you. Additionally, many payment gateways offer localized payment options, which can further enhance the customer experience for users in different regions.

How to integrate a payment gateway into your website?

Integrating a payment gateway into a SpreadSimple website is very straightforward and does not require any coding or developer experience. Here’s how the process goes:

Step 1. Begin by navigating to the checkout tab on your website's admin interface. From there, go to the Shipping, fees & payment menu.

Step 2. In the Payments menu, click on Enable new addon. This action will open a popup window where you can select from the available payment gateways.

Step 3. In the popup, choose one of the available payment gateways that suit your business needs. Once selected, switch the toggle to enabled.

Step 4. After enabling the first payment method, you can add additional options if needed. Repeat the process of selecting and enabling new payment gateways to provide your customers with multiple choices.

Step 5. You can personalize the titles and labels of each payment method to match your brand’s tone and make the options clear for your customers.

Step 6. You can designate one of the payment methods as the default option. Additionally, you have the flexibility to disable any payment method if needed.

Learn more about setting up payment on a SpreadSimple website with PayPal, Razorpay, and Stripe.

Choosing a payment gateway provider

When selecting a payment gateway provider, consider factors such as ease of integration, security features, supported payment methods, and fee structures. Here are a few popular options:

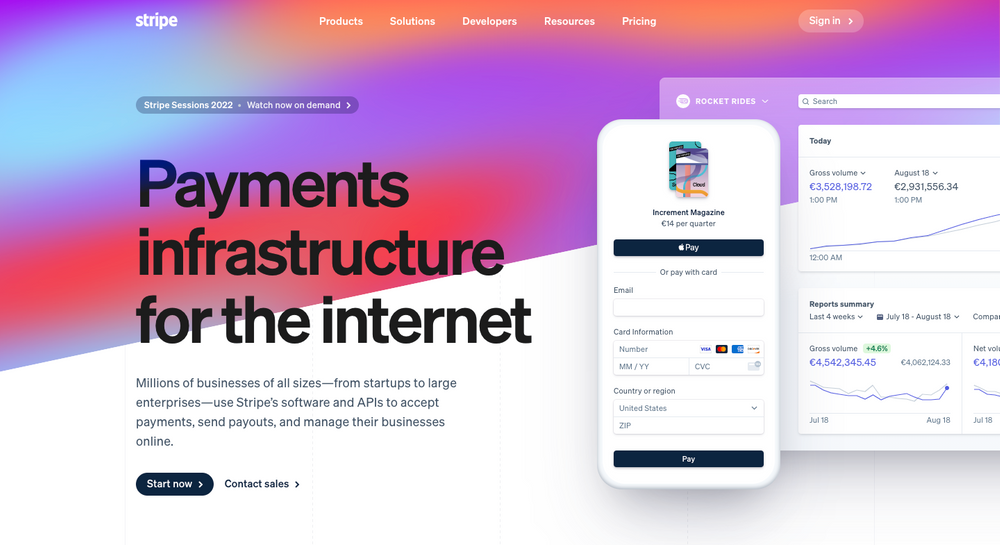

Stripe

Stripe is a comprehensive payment processing platform designed for businesses of all sizes. It is known for its developer-friendly APIs and robust feature set. You can easily add Stripe to your SpreadSimple website.

Key Features:

- Comprehensive dashboard: Stripe offers a user-friendly dashboard that provides insights into transactions, payouts, and customer data, making it easy to manage and track your business’s financial activities.

- Multiple payment methods: Stripe supports a variety of payment methods, including credit and debit cards, Apple Pay, Google Pay, and more, providing flexibility for your customers.

- Security: Stripe ensures high security with encryption, PCI compliance, and advanced fraud detection tools, protecting both your business and your customers from fraudulent activities.

- Clear fee structure: Stripe has a transparent fee structure, typically charging a flat rate per transaction, so you know exactly what you’re paying without any hidden fees.

- Built for and by developers: Stripe's API is highly customizable, making it a favorite among developers for its flexibility and ease of use. It allows for seamless integration and tailored solutions to meet specific business needs.

Billplz

Billplz is a cost-effective payment solution aimed at small to medium-sized businesses, particularly in local markets. Integration with Billplz is available on SpreadSimple.

Key Features:

- Low-cost solution: Billplz provides a straightforward, low-cost solution for local transactions, making it ideal for small businesses looking to minimize expenses.

- Instant payment notifications: it offers instant payment notifications and detailed transaction reports, enhancing financial tracking and ensuring you are always informed about your transactions.

Razorpay

Razorpay is an integrated payment solution that supports various payment methods and offers comprehensive analytics, catering to businesses in diverse industries. You can add Razorpay checkout to your website in just a couple of clicks.

Key Features:

- Multiple payment methods: Razorpay supports multiple payment methods, including UPI, credit/debit cards, net banking, and wallets, giving your customers plenty of options to choose from.

- Real-time insights and analytics: it provides real-time insights and analytics to help businesses monitor and optimize their payment processes, allowing you to make data-driven decisions.

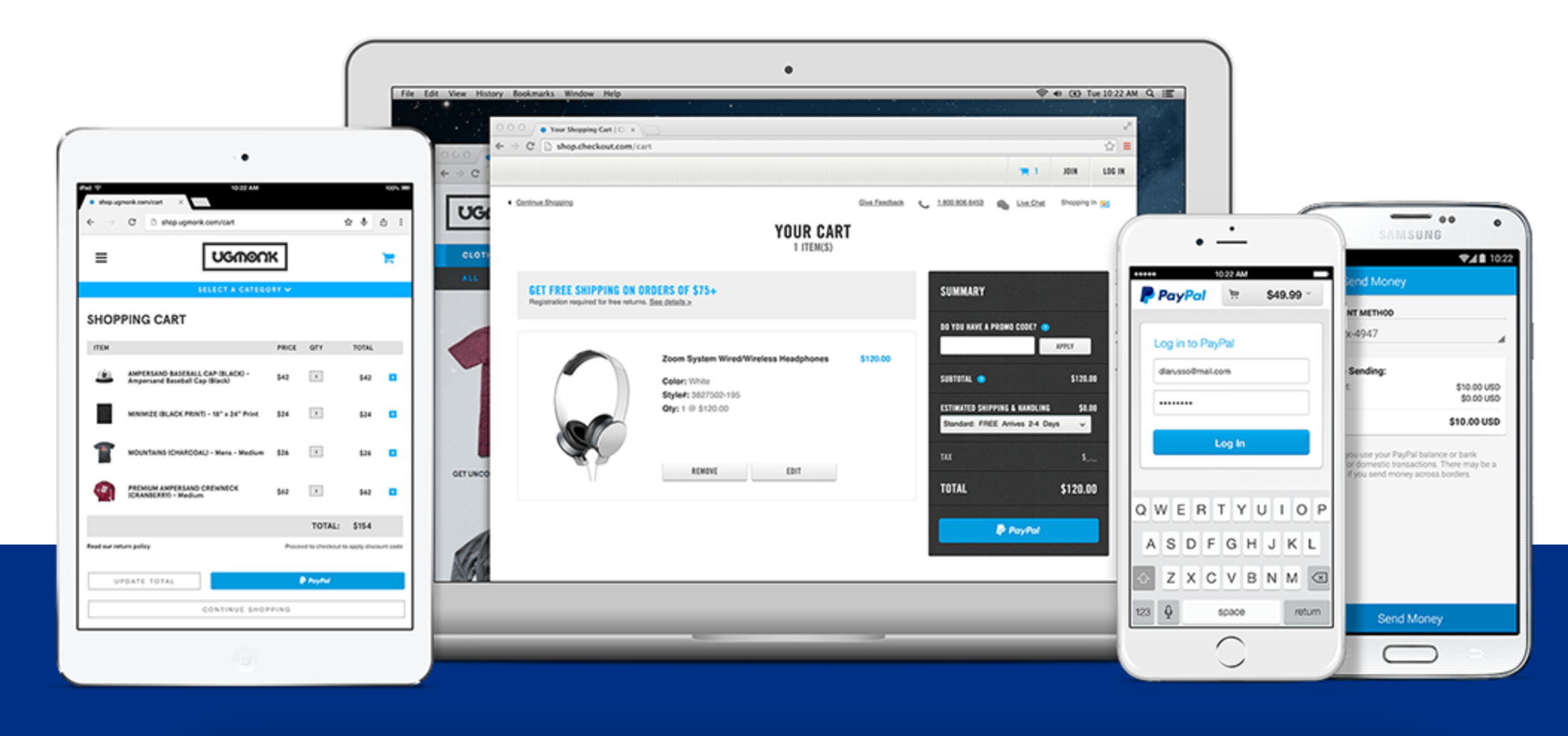

PayPal

PayPal is a globally recognized payment gateway known for its ease of use and trustworthiness among consumers and businesses alike. And it’s very easy to integrate with a SpreadSimple website.

Key Features:

- Widely recognized and trusted: PayPal is widely recognized and trusted by consumers, offering a familiar and secure payment option that can enhance customer confidence and increase conversion rates.

- Quick and easy setup: it allows for quick and easy setup, with no monthly fees and a pay-as-you-go structure, making it accessible for businesses of all sizes without significant upfront costs.

Payplug

Payplug is a user-friendly payment solution designed for small and medium-sized businesses, particularly those operating in Europe. It offers a simple and efficient way to accept online payments.

Key Features:

- Easy integration: Payplug provides straightforward integration options with various e-commerce platforms and website builders, allowing businesses to start accepting payments quickly and without hassle.

- Enhanced Security: Payplug ensures secure transactions with PCI DSS compliance, advanced encryption, and robust fraud prevention tools, safeguarding both merchants and customers.

- Multiple Payment Methods: Payplug supports various payment methods, including credit and debit cards, offering flexibility for customers and helping businesses cater to a broader audience.

- Transparent Pricing: Payplug offers a clear and competitive fee structure, charging a flat rate per transaction. This transparency helps businesses manage their finances more effectively.

- Customizable Checkout: the Payplug checkout page can be customized to match your brand’s look and feel, providing a seamless and consistent experience for your customers.

- Localized Support: Payplug offers support tailored to the European market, including local payment methods and customer service in multiple languages, enhancing the overall user experience.

Key takeaways on payment gateways integration

Integrating a payment gateway is essential for any business looking to accept online payments securely and efficiently. By choosing the right provider and following the integration steps, you can enhance the user experience, improve security, and expand your customer base.

SpreadSimple allows you to create a website and integrate a payment gateway in just a few simple steps, and it doesn't require any coding experience.

Frequently asked questions about payment gateways

Will my data be safe with a payment gateway?

Reputable payment gateways prioritize security to protect your data. Opt for providers that use advanced encryption methods and adhere to strict Payment Card Industry Data Security Standard (PCI DSS) compliance to ensure that all transactions are secure and prevent fraud and unauthorized access to sensitive information.

Does the payment gateway store the payment data of the clients on its server?

Most payment gateways securely store payment data to facilitate transactions and provide a seamless user experience. They follow stringent security protocols and standards to protect this information. However, the specifics can vary by provider, so it’s important to review their data handling policies.

Are there any industry restrictions for using a payment gateway?

Yes, some payment gateways have industry restrictions and do not support businesses in certain high-risk industries, such as gambling or adult services. It’s important to check the terms of service and acceptable use policies of the payment gateway provider to ensure your business complies with their requirements.

What are the fees for using a payment gateway?

The fees for using a payment gateway can vary by provider. Typically, you will encounter a flat rate per transaction, but some providers might also charge setup fees, monthly fees, or fees for additional services. It’s crucial to review the fee structure of the payment gateway provider to understand the total cost of using their service.

How do I integrate a payment gateway into my website?

ntegrating a payment gateway into your SpreadSimple website is simple and requires no coding experience. Follow these steps:

- Access the shipping, fees & payment menu in your website's admin interface.

- In the payments menu, click on enable new add-on. Select a payment gateway from the popup window and switch the toggle to enabled.

- Repeat the process to add additional payment gateways as needed, providing multiple choices for your customers.

- Adjust the titles and labels of each payment method to fit your brand and ensure clarity for your customers.

- Choose a default payment option and disable any methods that you don’t need.

Learn more about how to integrate payment gateways on your website.

Is it hard to integrate a payment gateway?

The difficulty of integrating a payment gateway depends on the provider and your technical skills. Many payment gateways offer user-friendly tools, plugins, and detailed documentation to simplify the process. Even if you lack technical expertise, you can often find step-by-step guides and customer support to assist you with the integration.